Per CNET:Įvernote, once considered a tech “unicorn” with a valuation of over $1 billion, is on the receiving end of much criticism and scrutiny this week, following the announcement of a price hike and device limitations for free users. Additionally, it began promoting Evernote Business to consumer users.Ĭonsumer and media outcry was immediate, particularly over social channels.

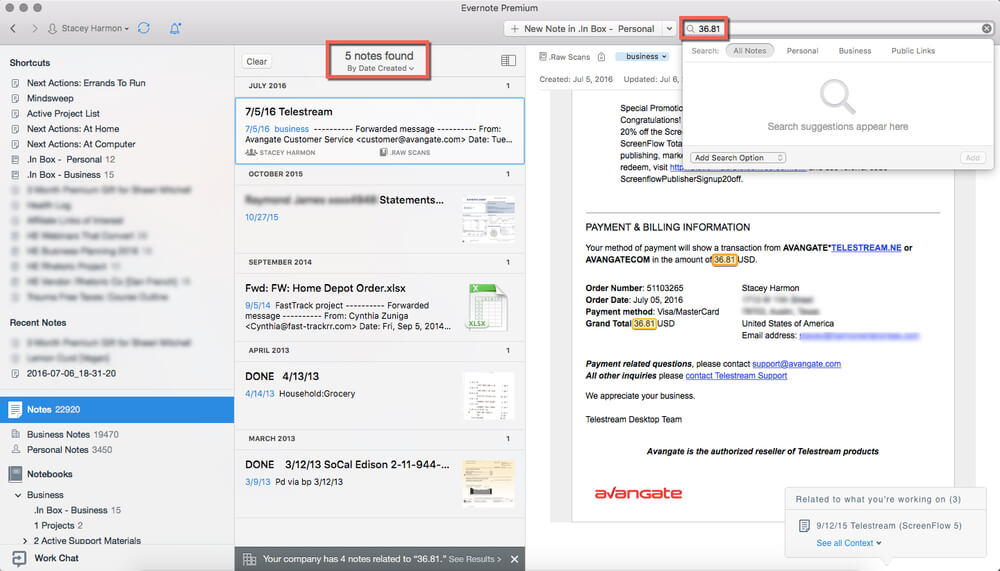

Most notably, the company added a two-device limit to its free-to-use Evernote Basic plan, while increasing subscription prices for its Evernote Plus and Premium plans. Such was the case earlier this year when Evernote, a popular cloud-based note-taking and collaboration tool (instantly recognizable to many by its green elephant logo), announced changes to its free and paid access plans.

Sometimes it can be hard to tell if you’ve struck the right balance. But when you get it right, you’ve got a genuine win-win proposition that generates long-term value for merchant and customer alike. When the price-value relationship falls out of balance, the impact can be immediate and lasting. Successful subscription offerings must make a consistent case for their enduring value to customers, month after month - while achieving the financial returns it takes for the retailer to stay innovative, competitive and profitable. That balancing act can be especially tricky for subscription-based ecommerce pricing models. Achieving the perfect balance between price and value is a fundamental challenge of commerce.

0 kommentar(er)

0 kommentar(er)